Securing a home loan can be a daunting task, but for veterans, active-duty service members, and eligible surviving spouses, the Va Home Loan Pre Approval Process program offers a streamlined path to homeownership. A critical step in this journey is the VA loan pre-approval process. This article provides a comprehensive, step-by-step guide to understanding the VA loan approval process, ensuring you are well-prepared to navigate it successfully.

What is the Va Home Loan Pre Approval Process?

The Va Home Loan Pre Approval Process is a series of steps that prospective homebuyers must complete to secure a VA loan. Pre-approval is an essential part of this process, as it provides a clear picture of your borrowing capacity and strengthens your position when making an offer on a home. Here’s a detailed look at each stage of the VA loan pre-approval process.

Step 1: Determine Your Eligibility

Understanding VA Loan Eligibility Requirements

Before starting the Va Home Loan Pre Approval Process, confirm your eligibility. The U.S. Department of Veterans Affairs sets specific criteria for VA loan eligibility, which include:

- Active-duty service members: Minimum 90 continuous days of active service.

- Veterans: At least 181 days of active duty during peacetime or 90 days during wartime.

- National Guard and Reserve members: Six years of service or 90 days of active service during wartime.

- Surviving spouses: Unremarried spouses of veterans who died in service or from a service-connected disability.

Step 2: Obtain Your Certificate of Eligibility (COE)

How to Get Your COE

The Certificate of Eligibility (COE) is a vital document in the VA loan approval process. It verifies to lenders that you meet the VA’s service requirements. You can obtain your COE in several ways:

- Online: Through the VA’s eBenefits portal.

- Lender: Your VA-approved lender can obtain it for you.

- Mail: Submit VA Form 26-1880 by mail to the VA.

Step 3: Check Your Credit Score

Importance of Credit Score in VA Loan Approval

While the VA does not set a minimum credit score requirement, most lenders prefer a score of at least 620. Review your credit report for errors and take steps to improve your score if necessary. Paying down debt and ensuring timely payments can boost your creditworthiness.

Step 4: Gather Financial Documents

Required Documentation

Lenders require various financial documents to assess your ability to repay the loan. Prepare the following:

- Proof of Income: Pay stubs, tax returns, W-2s, or 1099s.

- Employment Verification: Employment history and status.

- Asset Statements: Bank statements and details of other assets.

- Debt Information: Details of current debts and obligations.

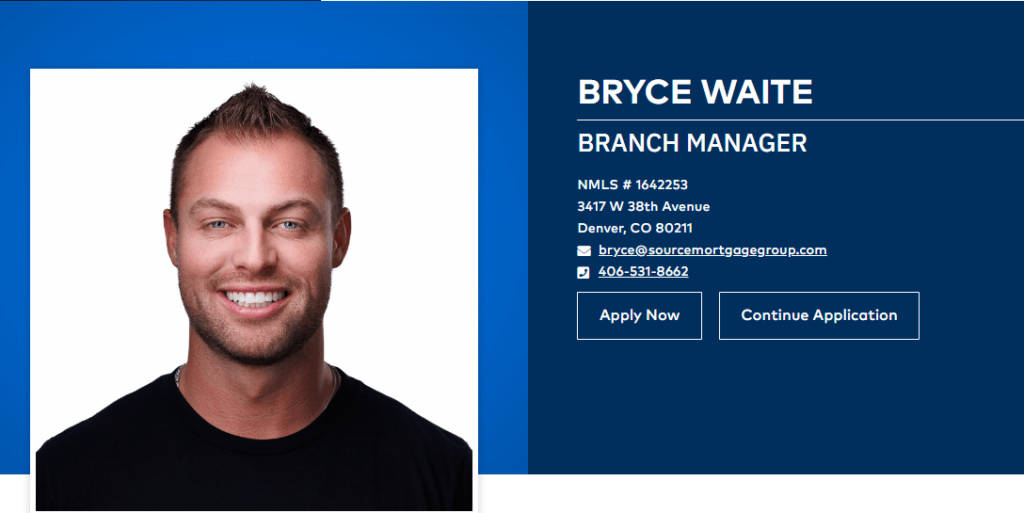

Step 5: Choose a VA-Approved Lender

Finding the Right Lender

Not all lenders are approved to issue VA loans. Research and choose a lender experienced in handling VA loans to ensure a smooth process. Compare interest rates, fees, and customer service to find the best fit for your needs.

Step 6: Submit Your Pre-Approval Application

Application Process

Once you have chosen a lender, complete the pre-approval application. This involves providing your COE, financial documents, and personal information. The lender will review your application, assess your creditworthiness, and determine how much you can borrow.

Step 7: Receive Your Pre-Approval Letter

Benefits of Pre-Approval

If your application is approved, you will receive a pre-approval letter. This document states the loan amount you qualify for and is valid for 60 to 90 days. Having a pre-approval letter strengthens your position when making an offer on a home, as it shows sellers that you are a serious and qualified buyer.

Step 8: Start House Hunting

Begin Your Home Search

With your pre-approval letter in hand, you can start searching for your new home with confidence. Work with a real estate agent experienced in VA loans to find properties that meet VA appraisal requirements and your personal preferences.

Conclusion

Understanding the VA loan approval process is crucial for veterans and active-duty service members aspiring to own a home. By following these steps, you can navigate the pre-approval process with ease, ensuring you are well-prepared to secure a VA loan. The VA loan program offers numerous benefits, including no down payment, competitive interest rates, and flexible credit requirements. Take advantage of these benefits by getting pre-approved and moving one step closer to homeownership.